Studies claim that the success of multinational companies within the Middle East hinges not merely on monetary acumen, but in addition on understanding and integrating into regional cultures.

Despite the political instability and unfavourable economic climates in certain parts of the Middle East, foreign direct investment (FDI) in the area and, specially, in the Arabian Gulf has been continuously increasing in the last 20 years. The relevance of the Middle East and Gulf markets is growing for FDI, and the associated risk appears to be crucial. Yet, research regarding the risk perception of multinationals in the area is limited in quantity and quality, as experts and attorneys like Louise Flanagan in Ras Al Khaimah would probably attest. Although different empirical research reports have investigated the effect of risk on FDI, most analyses have been on political risk. However, a brand new focus has materialised in present research, shining a limelight on an often-overlooked aspect specifically cultural variables. In these groundbreaking studies, the researchers remarked that businesses and their administration often seriously take too lightly the effect of social facets as a result of lack of knowledge regarding cultural factors. In reality, some empirical studies have found that cultural differences lower the performance of international enterprises.

This cultural dimension of risk management calls for a shift in how MNCs run. Adapting to local customs is not just about understanding company etiquette; it also involves much deeper cultural integration, such as for instance understanding regional values, decision-making designs, and the societal norms that influence business practices and employee conduct. In GCC countries, successful company relationships are made on trust and individual connections instead of just being transactional. Moreover, MNEs can benefit from adapting their human resource management to reflect the cultural profiles of regional workers, as variables affecting employee motivation and job satisfaction vary widely across cultures. This requires a shift in mind-set and strategy from developing robust economic risk management tools to investing in cultural intelligence and local expertise as consultants and solicitors such Salem Al Kait and Ammar Haykal in Ras Al Khaimah would probably suggest.

A lot of the existing academic work on risk management strategies for multinational corporations emphasises particular uncertainties but omits uncertainties that are hard to quantify. Indeed, a lot of research within the international management field has been dedicated to the management of either political risk or foreign exchange uncertainties. Finance and insurance literature emphasises the danger variables which is why hedging or insurance coverage instruments could be developed to mitigate or transfer a company's danger exposure. But, present research reports have brought some fresh and interesting insights. They have sought to fill area of the research gaps by giving empirical understanding of the risk perception of Western multinational corporations and their administration techniques at the company level within the Middle East. In one research after collecting and analysing data from 49 major international businesses that are have extensive operations in the GCC countries, the authors discovered the following. Firstly, the risk associated with foreign investments is clearly a great deal more multifaceted than the often analyzed factors of political risk and exchange rate exposure. Cultural danger is perceived as more important than political risk, monetary risk, and financial danger. Secondly, despite the fact that aspects of Arab culture are reported to really have a strong influence on the business environment, most firms struggle to adapt to regional routines and traditions.

Judd Nelson Then & Now!

Judd Nelson Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Loni Anderson Then & Now!

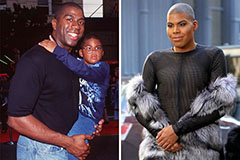

Loni Anderson Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now!